An option chain is divided into two categories: calls and puts. ‘Calls’ is the ability to purchase stocks or assets, while ‘puts’ is the ability to sell stocks or assets.

An options chain gives concise price quotations and details. It is different from the options cycle.

It is in a table-like form that displays the information a trader needs about options trading. An example of an options chain is the Sensibull Option Chain.

What is option chain analysis?

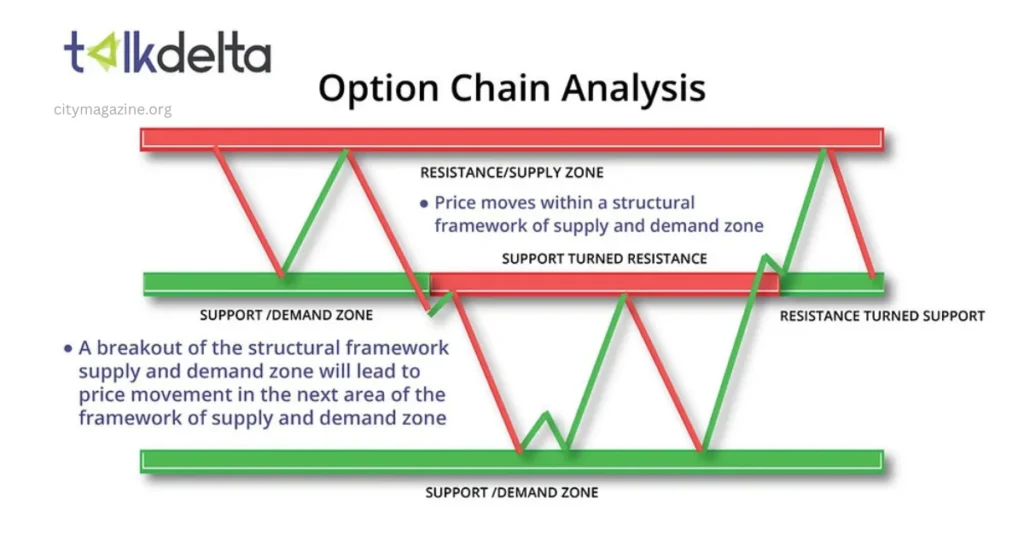

It is when you analyze all the listed option matrices in an options contract as a security measure. The lists show when the calls and puts were made. You will also find when calls and puts expire, their strike price tags, and their quantity. The strike price is the share price of when an investor purchases the shares listed in options. In addition, the price details for each asset for a particular period are stated in the listings.

In retailing, an option chain analysis is a normal way of giving information to potential investors. Different quotes are presented in the research, and analysis is done simply for easy understanding.

Moreover, online platforms and virtual brokers show option chain analysis via real-time data. An online trader can quickly scan the activities going on in the stock market. This includes the prices, interest rates, and market trends.

Additionally, a trader can check the assets’ activities, quantity, and expiration date for asset options trading. The trader can also sort out data accordingly.

Sensible Option Chain

SOC is a type of options trading established by Hassan, A., and others. Sensibull created a platform for options traders to facilitate trading. It is a digital platform that has a listing of trading methods according to the traders’ needs.

Furthermore, it includes price lists and potential risks, losses, or profits. Traders can compare and assess various trading techniques to know the best one. Other benefits include the date, spot, and invitation-changing options for traders.

Advantages of Suing Sensible Options Trading Platform

Calendars: It has a calendar that marks events for future reference. The calendar is automated to alert traders when a trading result comes out. It also has an alarm that warns a trader of possible trading risks. Its tracking feature makes it easy for traders to track big events in the stock market.

Tax predictions on transactions: The platform informs traders about taxes on transactions made during trading. It can also predict future tax rates and expiration dates.

Analysis Tool: It has a tool to analyze options chains, contracts, scenarios, trading patterns, and so on.

Conversion Tool: It has a tool for converting options trading to futures trading for a specific date. The conversion will depend on the trader’s price range for trading.

Digital Tools: It has digital tools like real-time displays, automated event notifications, and many more. These tools make trading easier and faster.

Trading Opportunities: Sensibull gives traders many trading opportunities.

How to Trade on Sensibull

- Create an account on the Sensibull Platform.

- Sign in to your account.

- Click on ‘dashboard’ displayed on your device screen.

- Go to ‘market view.’ Click to enter.

- Choose the trading strategy you want among the listed plans available.

- There is an ‘options order’; click on it. When you click on it, you have placed your options order.

- The last step is to view your order status.

Conclusion

Sensible options chain platforms have made trading simple for new traders. Thanks to digital tools, traders can easily navigate the media.