A low credit score can affect your ability to purchase a vehicle, a home, or other items on

credit. Damaging your is easy. Repairing your credit score is hard, but it is not

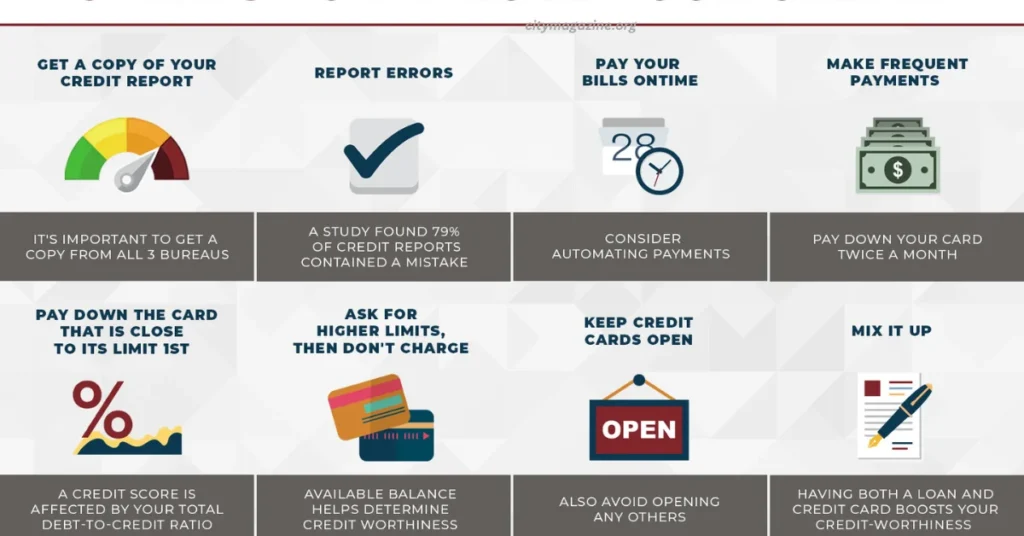

impossible. Here are some tips that can help you know where to get started.

Build Your Credit

The steps you must follow to improve your credit will vary based on your situation. If you

have no credit, you need to start opening accounts with institutions that report to the major

credit bureaus.

It is impossible to build a track record if you don’t have accounts in your name. It is good to have

multiple active credit accounts.

These accounts would include loans to build your credit, a secured credit card, or a card that

offers credit card rewards but doesn’t have an annual fee. You can be edadded as an authorized

user on another person’s credit card, but you want to ensure they use their credit cards

responsibly.

Pay on Time

The best way to improve your credit is to build a history of on-time payments. Don’t miss a credit

Card or Loan Payment by more than 29 days. If your prices are 30 or more days late, they

might get reported to the credit bureaus. This will damage your credit score.

You can set up automatic payments to cover your credit card minimums. If you can’t protect your

talk to your credit card company to find ways to lower credit card minimums.

Fix Past Due Accounts

Do you have a lot of bills that you are behind on? Making them current can help. Late payments

It may stay on your credit report for several years. Keeping your accounts current will help your

credit score.

If your credit card debt feels overwhelming, get help by talking to a credit counselor. They may

be able to intercede on your behalf, lowering interest rates and payments on your credit cards to

help you get your account current.

Minimize the Number of Accounts You Apply For

Every time you apply for a credit card, it is a hard inquiry. This will ding your score a little bit. Several hard questions can have a compounding effect on your credit.

Also, every new account you open lowers the average age of your funds. This hurts your

credit score. According to the expert at Sofi Invest, When you apply, Sofi conducts a soft

credit pull that will not affect your An approval application will result in a hard credit

pull, which may impact your credit score.”

How Long Does It Take to Fix a Bad Credit Score?

There is no set time limit. Several factors, including what is impacting your credit, the steps

needed to rebuild your credit, and your diligence at making payments all come into play.

Knowing your credit score and taking steps to improve it is essential. Review your credit score

monthly. It is automatically tracked and updated each month.