Owning a house of your own is every individual’s dream. However, with real estate properties touching sky-rocketing rates, a housing loan is the best resort to fulfill your dreams of securing a shelter for yourself and your near and dear ones.

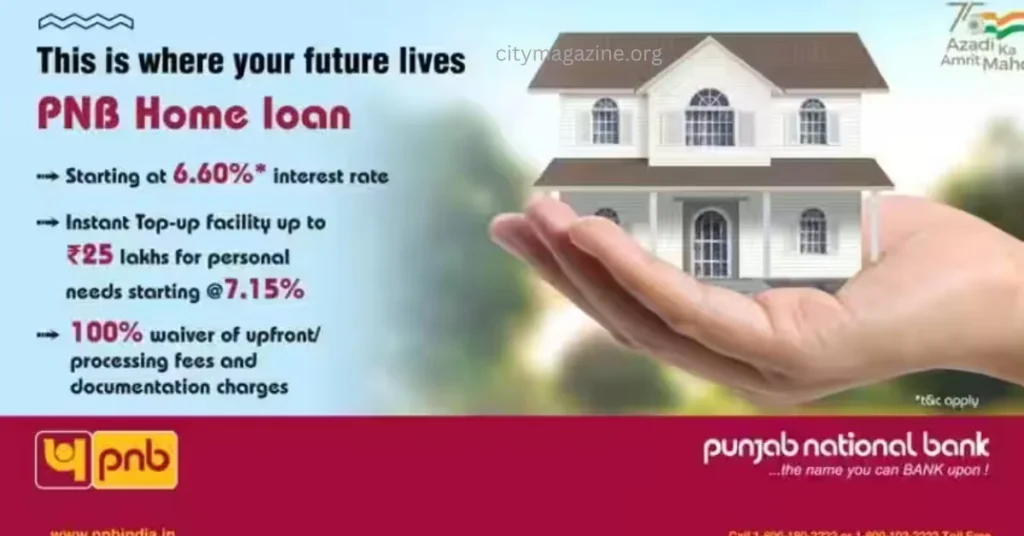

With a sea of options available for housing loans, getting your hands on the best and most lucrative deals can be arduous. However, the PNB Housing home loan offers multiple benefits under one umbrella and can be one of the best options for you to take home for your dream home. Here is what you need to know about it.

PNB Housing Loan details

PNB Housing Finance is a branch of Punjab National Bank. It offers interest rates for home loans starting at 6.99% per annum. This rate may vary depending on the nature of employment of the person applying for the loan and their credit score.

- The maximum repayment tenure for a home loan with PNB Housing Finance is 90 years.

- The maximum amount is up to 90% of the cost of the property.

- The processing fee rate is up to 0.5% of the total loan amount, plus taxes, subject to a minimum amount of Rs. 10,000

Features PNB Housing Loan Details

| Interest Rate | 6.99% p.a. onwards |

| Loan Amount | Minimum: NA, Maximum: 90% of property cost |

| Processing Fees | 0.25% – 0.50% of the loan applied for + Applicable Taxes (min 10000) |

| Penal Interest Rate | 2% per month on dues |

| Prepayment/Foreclosure Charges | NIL for floating-rate packages 2% to 3% for fixed-rate and non-individuals |

| Max Tenure | 30 Years |

| Rate Packages Available | Floating Rate |

Some additional perks

- PNB Housing loan does not require any guarantor

- They do not charge any pre-closure or part payment fee

- There is a facility for doorstep service

- You can apply for a top-up loan

- E-approval makes it easy to apply, process, and confirm the loan

PNB Housing Loan Interest Rates 2022 for different categories

| PNB Housing Finance Loans | Interest Rate (p.a.) |

| PNB Home Purchase Loan | 6.99% – 8.90% |

| PNB Home Improvement Loan | 6.99% – 8.90% |

| PNB Plot Loan | 7.99% – 9.90% |

| PNB Loan for NRIs | 7.35% – 9.10% |

| PNB Unnati Home Loan | 10.75% – 12.00% |

The above Interest rates are effective from 25 September 2021 and are subject to change at the bank’s discretion.

Documents required:

- KYC-PAN, address proof, and ID proof

- Income proof

- Bank statement

- Photograph

PNB House loan calculator

The PNB House loan calculator lets you calculate your loan amount in a minute. All you need to do is:

- Enter the loan amount

- Punch in the interest rate

- Feed-in the processing fee

- Mention the tenure

- Click on ‘Calculate.’

An amortization table would also give a detailed break-up of your repayment schedule.

Loan Eligibility

The PNB Housing loan can be availed only if the borrower’s age does not exceed 70 years at the time of the loan’s maturity.

Final Take

PNB Housing Finance offers one of the best rates for all categories of Housing loan requirements. Moreover, with the e-approval facility, applicants can apply online, upload documents on the portal, and even get a confirmation without physically visiting the branch. So, give wings to your dreams of owning your own house with a PNB Housing Loan.