A credit score signals lenders how responsible an individual is when managing credit. These numerical expressions are derived from reports compiled by the three major credit bureaus: Equifax, Experian, and TransUnion.

The rating is grouped from bad to excellent, ranging from 300 to 850. Remember that your score can vary depending on the method used to calculate it and the service provider.

Your credit score is greatly affected by your credit card usage, from opening the account and making monthly payments to closing the card account.

As such, it helps to use your cards wisely since your score guides the terms you get when applying for new credit facilities.

How credit scores are calculated

Credit scores are calculated using models based on an individual’s credit report. The two popular scoring models are FICO and VantageScore.

Some of the factors that are considered when calculating credit scores plus typical rating weight include:

- Credit accounts (15%)

- Credit usage (30%)

- Payment history (35%)

- Credit mix (10%)

- New credit inquiries (10%)

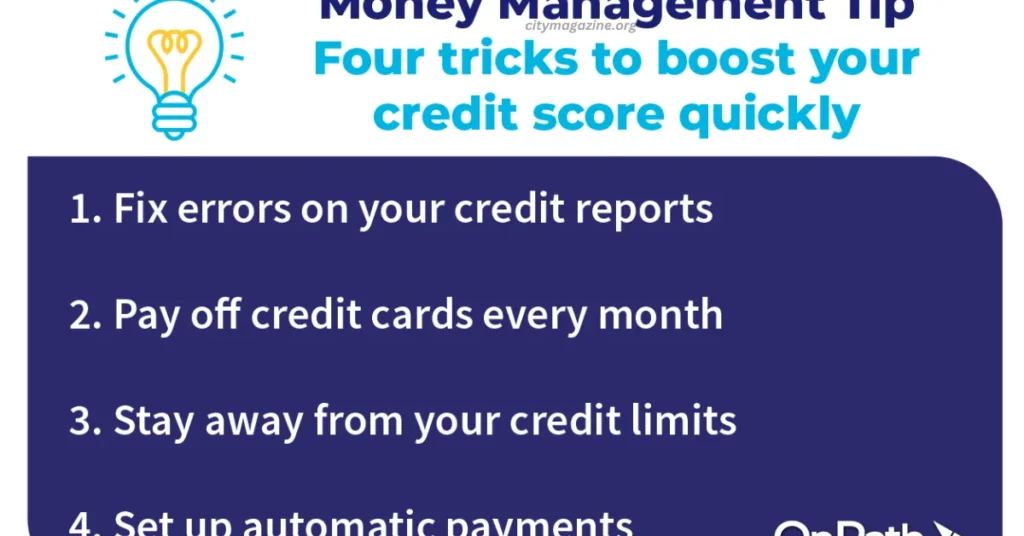

Tips to Boost Your Credit Score

Settle your bills early

Your payment history holds the most significant percentage (35%) in the credit scoring system. Furthermore, late payments (missing payments for 30 days or more) can stay on your report for up to 7 years.

One reason that can lead to late payments is borrowing beyond what you can afford, leading to civil court cases and bankruptcy.

If you are in such a situation, it’s best to contact your lender and request they don’t report the issue to credit bureaus. In return, come up with a payment plan that you can honor.

You can also consider setting auto payments from your checking accounts directly to avoid late fees.

Check for errors in your credit report.

Even the slightest mistake, such as a misspelled name or address, could hurt your credit score. Significant errors, such as accounts being mistakenly reported with late payments, incorrect balances, or double-recorded debts, can be more damaging.

All three main credit bureaus give their users one free credit report annually. If you happen to find any errors, dispute them immediately. The goal is to make sure that all information is not only corrected but also in real time.

According to research by the FTC, 26% of the participants had some error in their credit report. And even though it takes around a month for the bureaus to conclude investigations, disputing the mistakes can improve your credit score.

Remember that your credit score calculations are made from the information in your report, so any wrong information and the odds of improving your score are against you.

Be an authorized user.

Another way of improving your credit score is by becoming an authorized user of an existing account with a good track record. This is incredibly ingenious if you have a thin credit file.

Your friend’s card directly adds to your report’s history and increases your credit utilization. Typically, a low utilization percentage is what lenders like, with a rate below 30% being favorable.

The best thing about this approach is that you don’t have to have access to or use the account as long as you are listed as an authorized user. All you have to ensure is that the issuer reports to the bureaus.

However, in case of any late payments, your score and the card owner’s will be affected. The method is mainly done between spouses, close friends, or relatives who can be trusted.

Create your history.

While applying as an authorized user has its fair share of advantages, creating your credit history is equally important. Having no credit history means your track record is nonexistent, meaning there is no data to determine your creditworthiness.

Note that details such as bankruptcies, wage attachments, and foreclosures are also recorded in your credit report, and scoring systems consider the information.

Lack of personal credit history is a common issue affecting people who use joint cards, primarily children and couples. And in the case of divorce or death, it becomes hard to access credit.

Bottom line

Your credit score is unique and accurately measures your ability to sustain debt. Credit cards are more accessible to acquire than most other credit facilities. It makes sense that they can be used to boost credit ratings fast.

Even when starting from scratch, you can build credit using facilities such as secured credit cards whose limit equals your deposit. Also, when paying for rent and utilities, use your credit card and let your spending count towards your score.